We currently live in the era of buy now pay later (BNPL) apps, with popular platforms like Afterpay, Klarna, and Affirm leading the growing and evolving landscape. The beauty of these platforms is that they offer consumers the ability to purchase the products they want, no matter the price tag, and break them up into a series of more manageable payments. On the surface, it is a smart and flexible way to pay. However, the truth is that for many, this convenience is turning into a financial trap, one that could ultimately lead to overwhelming debt and the need to consider bankruptcy.

The Appeal and Risks of BNPLs

Younger consumers are flocking to the BNPL model for small and large purchases alike. The alluring appeal of splitting the cost of an item into four easy-to-manage payments can feel like a painless way to budget the things they desire, from food delivery to vacations. But young people aren’t the only demographic falling victim to surmounting BNPL debt; more established adults have found themselves needing to use the platforms to pay for simple expenses such as groceries and school supplies for their children. However, the ease of use these apps offer can quickly land buyers in hot water – because while it may be easy to manage one payment plan, BNPL users often accumulate multiple without much thought.

Now, you may be asking yourself, ” Why choose a buy now pay later app over a credit card?” The truth is that since these apps generally don’t require a hard credit check and can approve users within seconds, it’s simple to open several accounts and stack payments across different platforms. Add late fees, interest charges (for longer-term plans), and the temptation to spend more than you can truly afford, and many consumers find themselves unable to keep up.

How BNPL Debt Can Spiral Out of Control

We briefly touched on how BNPL can spiral out of control, but let’s dive a bit further into this madness. Unlike debt accumulated through credit card usage, BNPL debt has an invisible quality to it. When using a BNPL, you don’t receive the same type of monthly statement that consolidates all of your obligations in one place. Payments also may be automatically deducted, and before long, consumers may lose track of how much they owe.

If financial strain happens to hit heavy BNPL users, those small, manageable payments can snowball into something far more dangerous. Like credit cards, missing a BNPL payment doesn’t come without a penalty. Missing payments can cause late fees to accrue and even put a mark on your credit report. For some, what started as a handful of small purchases leads to thousands of dollars in debt across multiple BNPL platforms.

When Bankruptcy May Be the Right Solution

If BNPL debt is combined with other forms of unsecured debt like credit cards, personal loans, or medical bills, the situation can quickly become unmanageable. Collection calls, wage garnishments, and legal action could follow. In these cases, bankruptcy may offer a fresh start.

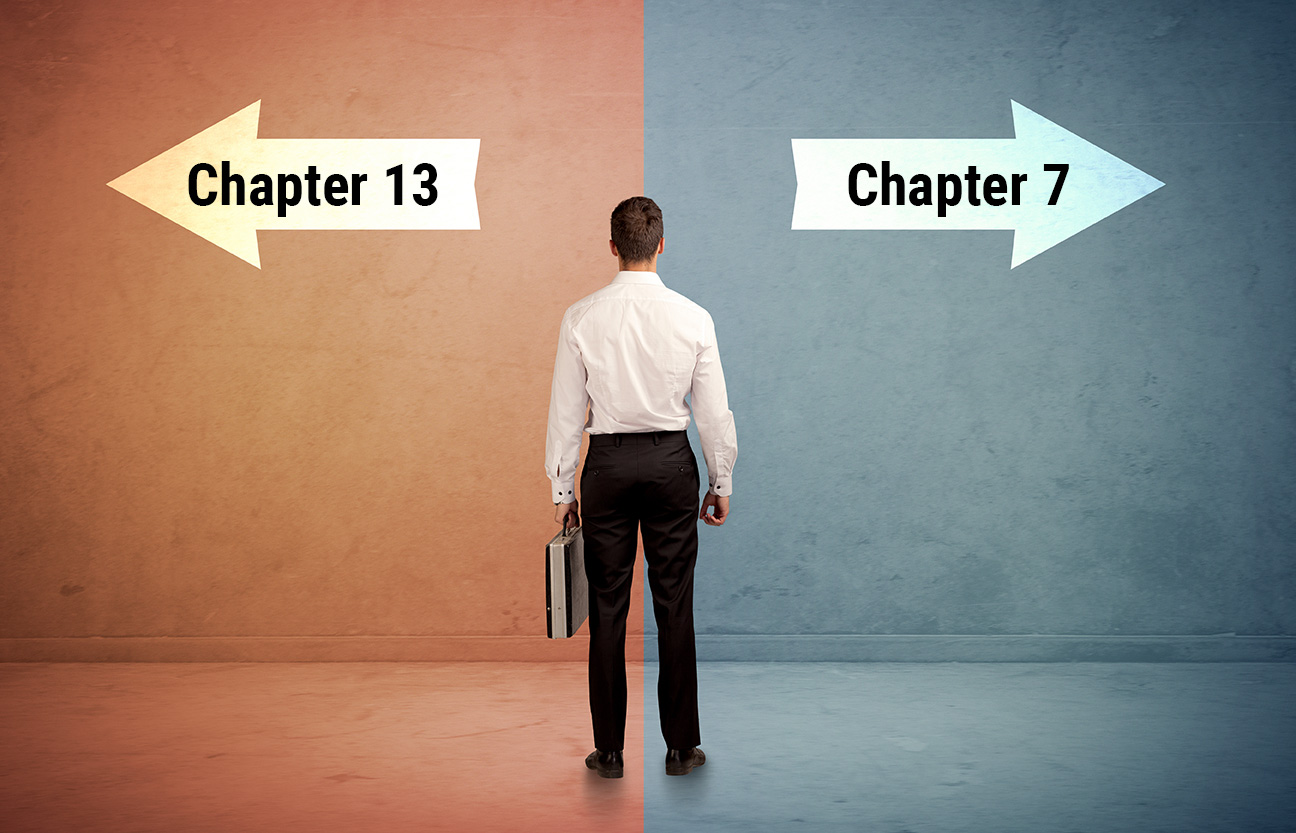

Bankruptcy, while often seen as a last resort, provides legal protections against creditors and a pathway to discharge qualifying debt. Depending on your circumstances, either Chapter 7 or Chapter 13 bankruptcy could help eliminate or restructure what you owe—including BNPL debts.

Don’t Navigate Debt Alone—Consult a Bankruptcy Lawyer

If BNPL debt has left you feeling overwhelmed, it’s important to seek professional guidance. A qualified bankruptcy lawyer can review your specific situation, explain your options, and help you determine the best path forward.

With over 25 years of law experience, Baltimore bankruptcy lawyer Adam M. Frieman is here to help you through every step of the bankruptcy legal process. Don’t let buy now, pay later debt dictate your future—reach out and take the first step toward financial freedom!