Preparation is essential for navigating most of the journeys you walk through in life. Making the decision to file for bankruptcy is a journey in its own right; one that requires a unique set of preparation steps, both practical and personal. While it may feel overwhelming at first, taking time to get organized and understand the process can ease much of the stress and help you move forward with confidence.

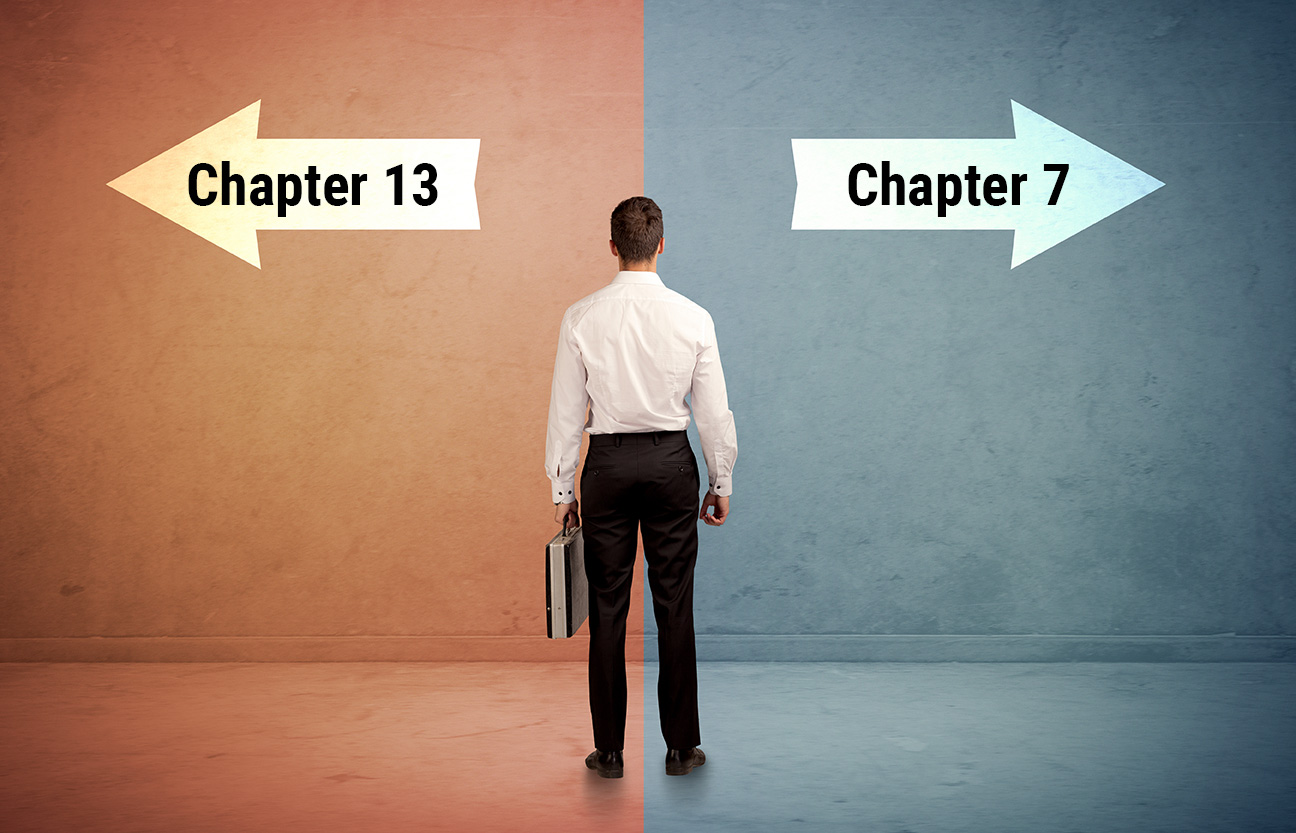

Whether you’re considering filing for Chapter 7 or Chapter 13 bankruptcy, taking the proper steps in advance can significantly impact the course of your case. Here are six tips to better prepare for your bankruptcy journey!

1. Understand The State of Your Finances

Whether it was credit mismanagement, medical debt, job loss, or divorce that landed you in your financial predicament, understanding the state of your finances and how they got there is essential before filing. You can start this process by taking inventory; ensure to assess all of your income sources, debts, assets, and expenses. Be honest and thorough; missing information can lead to delays or even case dismissal. And finally, take note of credit card balances, personal loans, medical bills, mortgage statements, car loans, and any judgments or garnishments against you.

2. Cut Up Those Cards

Making the choice to file for bankruptcy can be step number one in the journey for many people, but step number two often requires some serious habit changes. Whether it was credit cards or not that landed you in hot financial waters, you will need to stop using them and other forms of loans. Utilizing credit and loans while preparing for your bankruptcy case and claiming you are unable to pay any debts back can appear to be fraudulent activity. To protect your case and put the right foot forward, stick to essential purchases and avoid major transactions.

3. Keep Your Assets

Many who consider filing for bankruptcy fear losing some of their greatest assets, but it’s a totally normal feeling. However, many are also tempted to move those assets out of their name in an attempt to protect them; the truth is, the bankruptcy court considers this move to be a major red flag. Transferring assets, especially within a year before filing, may result in penalties, including your case being dismissed. Keep things transparent and let the bankruptcy process handle asset exemptions properly.

4. Stay Current on Essential Payments

To potentially protect your assets and not increase your debt, therefore not increasing the complexity of your case, it’s essential to stay current on your essential payments even when filing for bankruptcy. Whether it’s Chapter 13 or Chapter 7 bankruptcy, continue to pay secured debts as much as possible, including your mortgage or car loan. It’s also crucial to remain current on your utility bills and rent to prevent additional stress. While it’s not always possible to stay fully caught up, do your best to prioritize necessities.

5. Complete the Required Credit Counseling

Did you know that in order to officially file your bankruptcy case, you must complete credit counseling first? It’s true. Before filing for bankruptcy, you’re legally required to complete a credit counseling course from an approved provider. This course typically lasts about an hour and can often be done online. You’ll receive a certificate of completion that must be filed with the court.

6. Consult a Bankruptcy Lawyer

Perhaps the most important step you can take is speaking with an experienced bankruptcy lawyer. Bankruptcy law is complex, and every case is different. A skilled attorney can help you understand your options, determine and avoid costly mistakes. They can also protect you from creditor harassment and ensure all paperwork is filed correctly and on time.

If you’re feeling overwhelmed by the idea of filing for bankruptcy, you’re not alone. You don’t have to do it by yourself, and you shouldn’t. Attorney Adam M. Freiman has been practicing law for over 25 years. He understands the stress you’re under and is here to guide you with experience, compassion, and clarity.

Contact Adam’s office today to schedule a free consultation and take the first step toward your financial fresh start.