High-income earners can still get into debt and have difficulty repaying these debts. However, they often assume bankruptcy is not an option for them. While it is true that higher income can limit eligibility for certain chapters, bankruptcy law still provides several powerful tools for individuals and business owners with substantial earnings, complex assets, or significant debt. The key is choosing the right chapter and filing strategy.

High-income earners often face greater scrutiny from trustees and creditors. Luxury assets, bonuses, stock options, and deferred compensation must be fully disclosed and properly valued. Strategic pre-bankruptcy planning can help protect exempt assets, reduce risk, and avoid allegations of fraud.

Bankruptcy is not a one-size-fits-all approach, especially for high-income individuals. With careful planning and the right chapter selection, bankruptcy can provide powerful relief while preserving long-term financial stability.

Bankruptcy Choices for Individuals with Higher Incomes

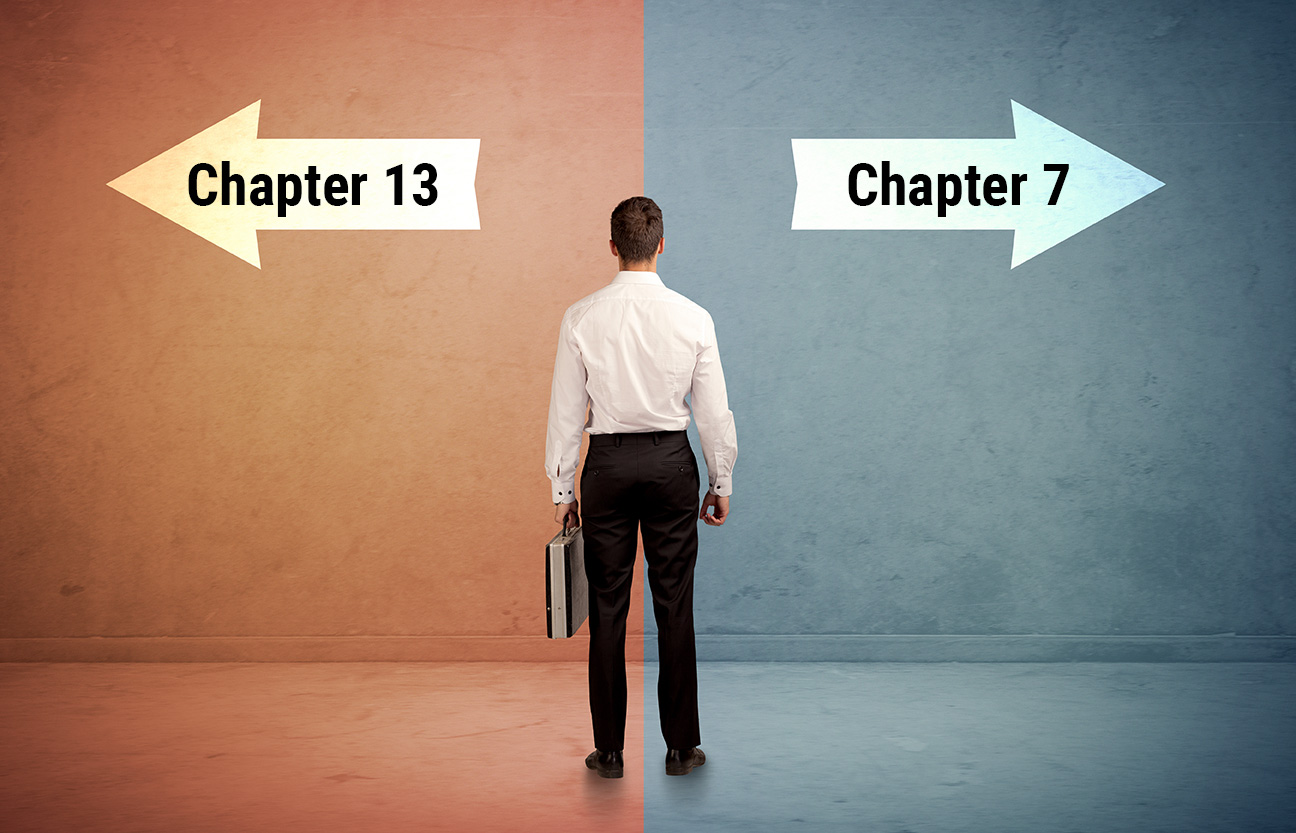

Chapter 7 and the Means Test

For high-income earners, Chapter 7 is the least likely option to get rid of debt. Qualifying for Chapter 7 can be challenging due to the bankruptcy means test. This test compares your household income to the median income in your state and evaluates allowable expenses. If your income exceeds the threshold, you may still qualify by demonstrating high secured debt payments, business expenses, tax obligations, or other allowable deductions. However, failing the means test generally pushes high-income filers toward reorganization options.

Chapter 13 for Structured Repayment

Chapter 13 is often the most practical option for high-income earners who do not qualify for Chapter 7. Also known as a wage earner’s plan, Chapter 13 allows debtors to restructure and repay a portion of their debts over three to five years while protecting assets such as homes, vehicles, and retirement accounts. High-income filers are typically required to commit to a five-year repayment plan and may pay more to unsecured creditors based on disposable income calculations. Chapter 13 can also be used to catch up on mortgage arrears, get rid of junior liens, and manage priority tax debt.

This option allows you to keep all of your property, including non-exempt assets and secured property like your home and car. It also stops most collection efforts and protects co-signers on consumer debts. However, you must commit to a strict budget and multi-year repayment plan and may not incur new debt.

Individual Chapter 11 and Subchapter V

For bankruptcy choices for individuals with higher incomes, significant assets, or business-related debt exceeding Chapter 13 limits, Chapter 11 may be the best solution. Subchapter V of Chapter 11 has made reorganization more accessible by reducing costs, streamlining procedures, and eliminating the absolute priority rule in many cases. This option is particularly useful for self-employed professionals, real estate investors, and business owners who need flexibility and control over restructuring.

Contact Us Today

There are bankruptcy choices for individuals with higher incomes – it just takes strategic planning. Consulting an experienced bankruptcy attorney is essential to navigate eligibility rules, protect assets, and develop an effective strategy. If you earn a lot of money and are considering bankruptcy, discuss your situation with The Law Offices of Adam M. Freiman. We will help you understand your options. Schedule a consultation today to learn more. Call (410) 486-3500 or fill out the online form.