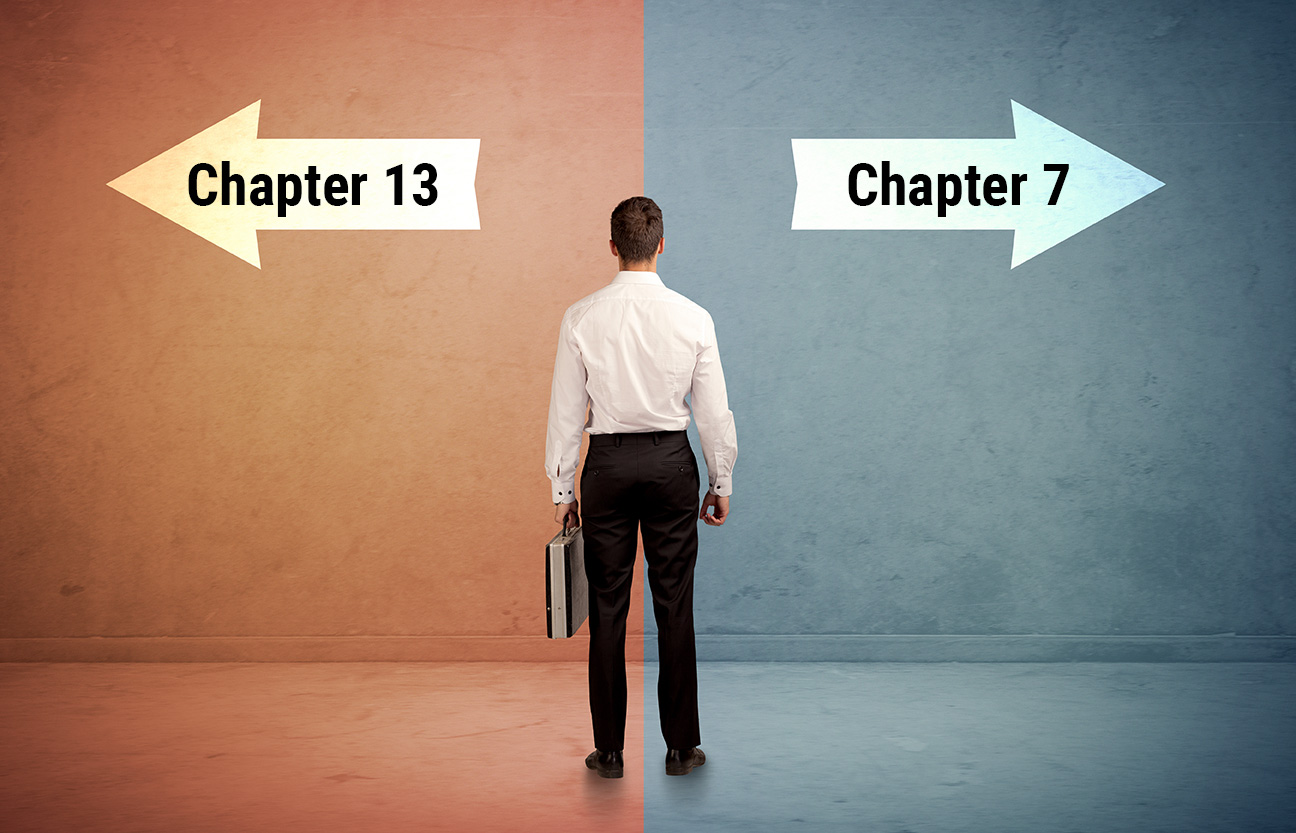

As a consumer, you have two main types of bankruptcy to choose from: Chapter 7 and Chapter 13. Chapter 7 is an easy way to wipe out debt, but it can cause you to give up some assets in the process. For those who still earn some income, Chapter 13 bankruptcy is a good option.

However, with Chapter 13, there are several key aspects involved. Your debts do not get wiped away. You have to pay them down to some degree with a repayment plan. You must create the repayment plan, but it cannot just be any type of plan. The plan must be approved by the court, and it must be filed within 14 days of submitting the petition.

In order to be approved, the plan must allow for regular, fixed payments to a trustee, who is a person or organization that oversees the repayment plan and manages the assets in a bankruptcy case. The payments must be made biweekly or monthly. The trustee then distributes the funds to creditors.

The plan may offer some creditors less than full payment on their claims, but it must pay priority claims in full. Priority claims are those granted special status, such as most taxes and the costs associated with the bankruptcy proceeding. There are also secured claims, which have collateral tied to them (such as a mortgage or auto loan). Finally, there are unsecured claims, in which the creditor has no special rights to collect property (such as credit card debt).

Creating a Plan

A Chapter 13 repayment plan typically lasts three to five years. This will depend on the debtor’s income as well as the court’s decision. The length of the plan is determined by comparing the debtor’s monthly income to the applicable state median income. If the debtor’s income is less than the state median, the plan can be three years. If it is higher, it is usually five years. The plan outlines how the debtor will repay their debts over this period, with specific provisions for secured and unsecured debts, as well as priority debts.

Understanding exactly how debt can be restructured under a Chapter 13 repayment plan can be confusing. Your lawyer can help you understand your options under bankruptcy law and create the right plan.

Priority debts must be paid in full. Secured debts are also generally paid in full over the plan period. However, unsecured debts do not necessarily have to be. These are not a priority and may be repaid in part or in full, depending on the debtor’s disposable income, which refers to how much money is left after deducting essential living expenses. The disposable income is then allocated to debt repayment.

Contact Us Today

Chapter 13 is a different type of bankruptcy compared to Chapter 7, and it is more complicated. You will need to create a repayment plan based on your income.

The Law Offices of Adam M. Freiman will work with you and the court to create the ideal repayment plan. We will also negotiate with your creditors and represent you in court. Count on us to guide you through every step of the bankruptcy process. Schedule a consultation today by filling out the online form or calling (410) 486-3500.