In the ever-evolving economic landscape, financial stress is abundant for Americans. The current climate is causing more bills to pile up, more creditor calls to go out, and ultimately, financial pressure to build. This pressure can feel impossible to escape and can cause a notable decline in the mental health of otherwise healthy individuals. For many people, the thought of filing for bankruptcy adds to that stress, but in reality, bankruptcy can be a crucial step toward restoring both financial stability and mental health.

The Emotional Weight of Debt

Debt doesn’t just affect your wallet; it affects your mind. The lingering worry over how to make ends meet or how to support a family can create a sense of hopelessness that spills into every part of daily life.

Many people feel trapped in a cycle where paying one bill means falling behind on another. Collection calls, wage garnishments, or threats of repossession or foreclosure can make it difficult to focus on work, relationships, or personal goals. It’s not uncommon for those struggling with debt to feel embarrassed or isolated, believing they’ve failed financially.

However, the truth is that life happens. Unexpected medical expenses, job loss, or economic downturns can put anyone in a financial bind. Bankruptcy exists as a legal tool designed to help individuals regain control, not as a punishment.

Bankruptcy as a Fresh Start

The emotional weight of debt almost vanishes upon filing for bankruptcy. That is all thanks to the beauty of the automatic stay. If you are new to the bankruptcy world, you may be unsure of what an automatic stay is. Simply put, an automatic stay is a legal protection that puts debt collection efforts to a halt. That means no more harassing phone calls, no more letters demanding payment, and no more threats of legal action. This instant peace of mind allows people to breathe again and begin focusing on recovery instead of constant panic.

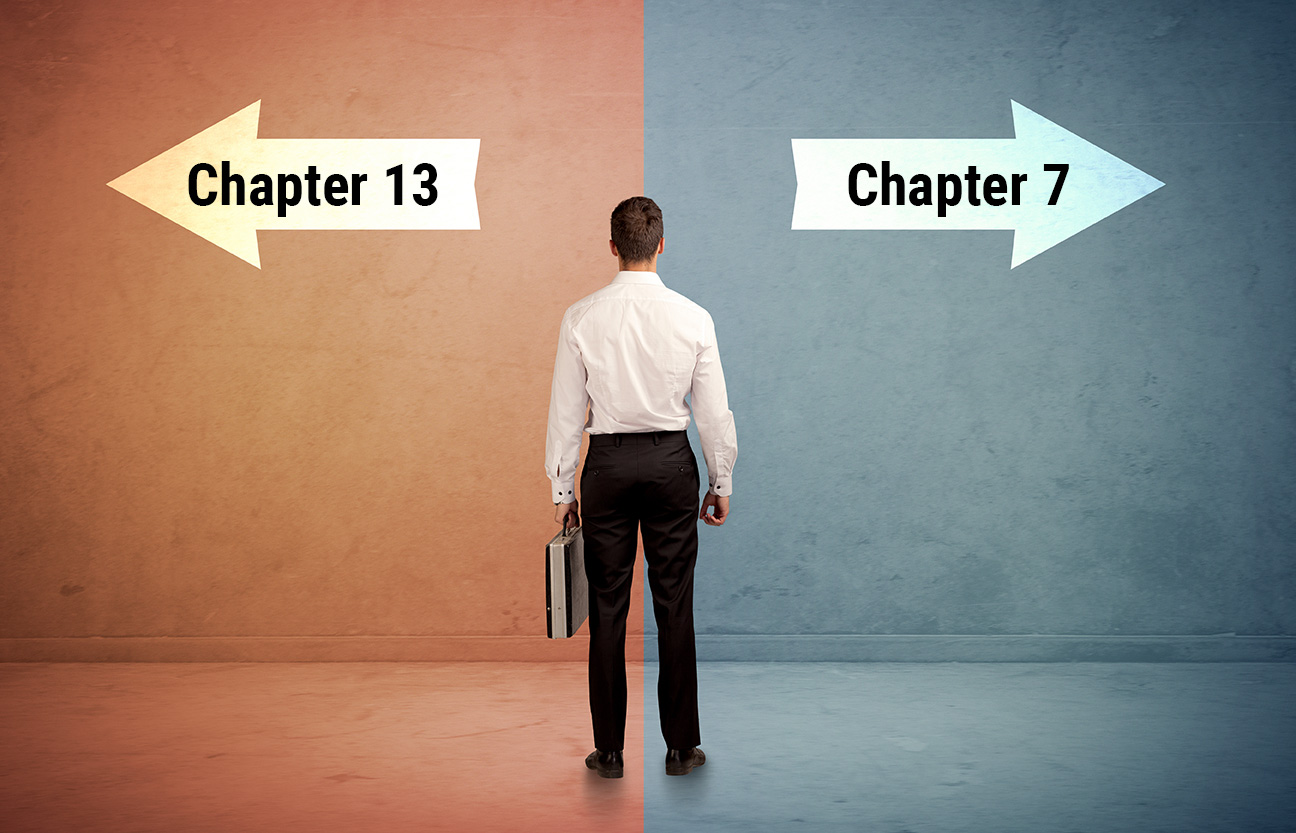

Bankruptcy also provides a clear path forward. Whether you qualify for Chapter 7, which discharges most unsecured debts, or Chapter 13, which allows you to pay back a portion of your debts through a structured plan, both offer a sense of direction. Instead of running yourself into despair trying to stay afloat, you can start working toward a clean slate. That sense of progress can do wonders for your mental health and self-esteem.

Reducing Anxiety and Rebuilding Confidence

Once the immediate stress of collection calls and mounting bills is lifted, most people experience an almost instant sense of relief. The fog of anxiety begins to clear, and for the first time in a long while, there is space to think about the future instead of just surviving the present.

Filing for bankruptcy allows you to take back control of your financial life. That sense of empowerment and of finally doing something proactive can dramatically improve your mental outlook. You are no longer waiting for the next bill or creditor threat to dictate your mood or decisions. Instead, you are taking a structured and legal path toward resolution.

As your case progresses, the positive mental effects can continue to grow. You begin to see a way forward: rebuilding credit, managing finances wisely, and learning from past experiences. Each step in the process reinforces stability and reduces the fear that once dominated your daily life.

The Long-Term Mental Health Benefits

Beyond the initial relief, bankruptcy can have lasting benefits for your mental health. Removing the weight of debt opens the door to better decision-making and improved emotional balance. When your mind is no longer preoccupied with financial panic, you can focus on things that truly matter, such as your health, your relationships, and your personal goals.

Bankruptcy also helps to reduce feelings of shame or failure that often accompany financial hardship. It reminds people that there is a way out and that using legal protections to regain stability is not a sign of weakness, but of courage. Over time, this shift in mindset promotes healing and renewed self-confidence.

Taking the First Step Toward Peace of Mind

Making the decesion to file for bankruptcy is never easy, but it is often the turning point toward a healthier, more secure future. It allows individuals to stop merely surviving under debt and start living again with clarity, stability, and hope.

If you are struggling under the weight of overwhelming debt, consulting an experienced bankruptcy lawyer like Adam M. Freiman can provide the guidance and reassurance you need. A knowledgeable attorney can help you understand your options, explain how bankruptcy may benefit your situation, and walk you through each step of the process.

Filing for bankruptcy is more than a financial decision. It is a choice to prioritize your well-being, take control of your circumstances, and move toward a brighter, calmer future. Contact Adam’s office today to find out more about how he can help you navigate the legal side of bankruptcy!