Medical bankruptcy typically occurs when a person’s medical bills exceed their ability to pay, leading to financial hardship. This can happen for several reasons:

- Inadequate Health Insurance: Some individuals may have health insurance coverage, but it may not cover all necessary medical treatments, leading to significant medical debt.

- High Deductibles and Co-pays: Even with health insurance, some policies require individuals to pay high deductibles and co-pays, which can become unaffordable for those with chronic or severe medical conditions.

- Uninsured or Underinsured: People without health insurance or with minimal coverage are particularly vulnerable to medical bankruptcy as they are responsible for the full cost of medical care.

- Loss of Income: Serious illnesses or injuries may result in a person being unable to work, leading to a loss of income while medical bills continue to accumulate.

- Non-Medical Costs: In addition to medical bills, individuals facing serious health issues may also incur other costs, such as transportation, lodging, and caregiving expenses.

- Prescription Medication Costs: Some prescription drugs can be extremely expensive, especially for ongoing or specialized treatments, which can contribute to medical debt.

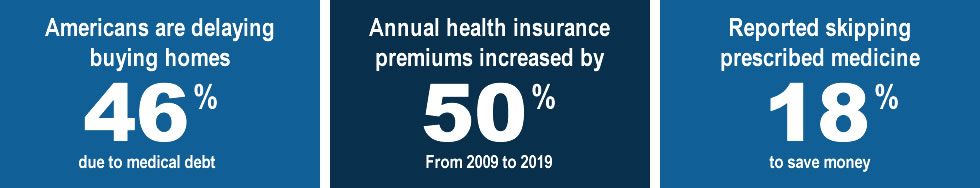

In fact, any unexpected illness or accident can potentially put people at risk whether they have insurance or not. When your medical coverage is tied to your employment and employment ends because of illness – medical debt and out of pocket expenses can rapidly compound.

A recent study by The American Journal for Public Health found that as many as 6 in 10 Americans who filed for bankruptcy did so as a result of overwhelming medical bills. The study cited both the high cost of care, and the lack of adequate insurance as contributing factors. Many people I meet with on a daily basis are concerned about the answer to one question:

Can I include my medical bills in a bankruptcy filing?

The short answer is, yes. Medical bills owed directly to doctors, and those owed to hospitals, treatment centers, rehabilitation clinics and the like can be included in bankruptcy, regardless of which chapter you file. Even bills resulting from car accidents can be discharged. It is very important to realize, however, that which chapter you file can directly impact how much, if anything, you are required to repay to your care providers. To determine which chapter is appropriate for you, you should seek the advice of an experienced bankruptcy attorney, such as those practicing at Freiman Law, P.C. and The Law Offices of Adam M. Freiman. For a general overview of the types of bankruptcy which may be available to you, continue reading below.

Medical Bankruptcy

Most people who file for bankruptcy do so under one of two chapters which are available to consumers who face mounting debt. The preferred path would be to file Chapter 7 bankruptcy, in which a Trustee is appointed to determine if you have any assets sufficient to pay some, or all of your debts. If you do not have sufficient assets, the Trustee will so report, and any debt that is unsecured, with some notable exceptions, will be discharged. Upon the discharge of the debt, you will no longer be responsible for payment. Exceptions to debts that may be discharged vary, but include some tax debt, some student loan debt, or debts created through fraud or trickery. In order to successfully file and be discharged in Chapter 7, one must pass the “means test”, which is an income-based analysis to determine if you have the ability to repay the debt through a Chapter 13 filing, as discussed below. The “means test” is but one of the many reasons filing with an experienced bankruptcy attorney is so important.

Chapter 13 Bankruptcy

If you have assets that need protecting, or if you do not pass the “means test”, a Chapter 13 filing can be an excellent way to eliminate medical debt. Chapter 13 is a repayment plan, where payments are made to a Trustee, who then distributes them equally among those that are owed money, including doctors and hospitals. There are several key components to a Chapter 13 filing that make it attractive for those facing mounting medical bills, and an inability to file Chapter 7. First, the interest on your unsecured debt, including medical bills, stops as of the day your case is filed with the court. This can save thousands of dollars in interest which would accrue but for the filing. Second, creditors must file proof with the court that their claim is valid, and a person in Chapter 13 has the opportunity to review and challenge those claims. Only a timely filed, valid claim can be paid in Chapter 13. If a creditor does not file a claim, or if their claim is reduced or eliminated, that debt disappears upon the discharge of your case.

As the reader can see, bankruptcy can be complicated, and you do not want to attempt it without an experienced bankruptcy lawyer to guide you. Call Freiman Law, P.C. and The Law Offices of Adam M. Freiman today to schedule a consultation at no charge. All you have to lose is the debt you are in.